☐ | Preliminary Proxy Statement | ||||

☐ |

| ||||

☒ | Definitive Proxy Statement | ||||

☐ | Definitive Additional Materials | ||||

☐ | Soliciting Material Under §240.14a-12 | ||||

Jacobs (Name of Registrant as Specified In Its Charter) N/A (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check | |||||

| ☒ | No fee required. | ||||

| ☐ | |||||

| |||||

| Fee paid previously with preliminary | ||||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

Meeting of Shareholders & Proxy Statement |

| Challenging today. Reinventing tomorrow. | |||

Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | ||||

| ||||

At Jacobs, we make the world smarter,more | ||||

connected and more sustainable. |

Notice of 2018

Annual Meeting of Shareholders and Proxy Statement

Jacobs Engineering Group Inc.CEO’s Message

FY23 notable recognition |

◾ Received the World Environment Center’s prestigious 2023 Gold Medal Award recognizing our sustainability transformation. ◾ Placed on Dow Jones Sustainability World Index 2022 and CDP’s A List for Climate for the first time. ◾ Ranked N° 1 on Engineering News-Record (ENR)’s list of Top 500 Design Firms for the sixth consecutive year, and N° 1 on ENR’s Top 50 Program Management Firms for the third consecutive year. ◾ Awarded five-star leader rating for climate & ESG impact by Environment Analyst in 2023. ◾ Named on Forbes’ The World’s Top Female-Friendly Companies 2022. ◾ Received a prestigious “Gold” 2023 Brandon Hall Group HCM Excellence Award for our global CEO Leadership Roundtable program. |

Fellow shareholders,

A dynamic business for a changing world

Universally, our clients are being asked to do more, faster and with less, whether it be managing skills shortages, tighter budgets or supply chain limitations, all while navigating global climate change and complex geopolitical conditions. We’re seeing larger, more multifaceted projects across key sectors aligned to critical infrastructure and sustainability. Anticipating the global mega trends most important to our clients, we’re leveraging the science-based, deep domain experience we’ve gained over decades to solve complex challenges around climate response, social value, resource constraints, cybersecurity, data and technology.

With the transformational moves within our portfolio in the sectors we serve, I firmly believe this is the time for us to capitalize on opportunities to lead our industry, while optimizing and streamlining our business to accelerate organic growth.

As we work on some of the most critical infrastructure projects around the world, we’re positively advancing what thoughtful, quality and nature positive infrastructure can do to support our communities in the future and how we can help promote equitable systems.

LETTER TO SHAREHOLDERSOur strategy is taking Jacobs to new levels of success by focusing on three significant growth accelerators — climate response, data solutions, and consulting & advisory services. Climate change is the biggest global disruptor of our time, and the way it impacts people’s everyday lives speaks to the importance of how we act now and plan for the future. Our climate response accelerator is focused on end-to-end solutions that we co-create with our clients in energy transition, decarbonization, adaptation & resilience, and regenerative & nature-based climate solutions.

FROM OUR CHAIRMAN & CEOWe’re helping clients navigate the future around clean, secure, affordable energy supply, decarbonization, electrification demand and decentralization. Opportunities around clean energy and utility grid infrastructure upgrades continue to expand — as reflected by our work with National Grid in the U.S. and the U.K., SuedLink in Germany, Fortescue Future Industries globally, and one of the largest offshore wind ports in the U.S., the South Brooklyn Marine Terminal. In addition, we’re designing, engineering and delivering electric vehicle (EV) and battery manufacturing facilities for four of the largest EV manufacturing plants in the U.S., and helping transit agencies, municipalities and state transportation departments electrify and green their fleets. With the U.S. CHIPS Act and similar legislative drivers, we’re capturing aligned opportunities in semiconductors, particularly in the U.S., Europe and the Middle East, as the world reshapes global supply chains. We’re also partnering with the world’s leading Life Sciences firms to advance transformative treatments and therapies — delivering advanced manufacturing facilities that positively impact people’s lives and shape a better tomorrow.

Dear Fellow Shareholder,

ThereClimate change, compounded by population growth, water scarcity and vulnerability to natural hazards, has never beenincreased the need for integrated, scalable solutions for resilient water resources. From coastal protection and ecosystem restoration to OneWater planning, where we take a holistic view across the entire water cycle, we support some of the largest programs globally — like our work with the Las Virgenes-Triunfo Pure Water Project and Singapore Public Utilities Board.

| ii |  | 2024 Proxy Statement | 2024 Proxy Statement |

Our continued focus on data solutions is crucial to supporting these projects. We’re investing in big data, artificial intelligence (AI) and generative design while building a technology backbone that enables us to add value in a more exciting timeefficient way. We’re developing proprietary solutions and also working in partnership with Palantir to be at Jacobs.develop smart algorithms and create a consistent and scalable product that connects predictive AI modeling with day-to-day operations and process optimization for clients. We’re using our digital products, Aqua DNA and Intelligent O&M, to assist the City of Wilmington, U.S., to reduce chemical and energy consumption and make positive environmental impact through smarter deployment of preventative maintenance activities.

Our majority investment in PA Consulting is also proving highly successful with synergies in our consulting & advisory services accelerating opportunities in multiple sectors as we discover new opportunities that deploy our complementary strengths. Together, we’re providing strategic management and technical services to The Company’s performance remains solid,Copenhagen Metro, one of the most advanced public transport systems in Europe.

Our transformation trajectory

We also reached an important milestone in our journey to become a more streamlined and higher value company focused on addressing critical infrastructure, advanced manufacturing and sustainability challenges. In November 2023, we entered into a definitive agreement to spin-off and combine our Critical Mission Solutions and Cyber & Intelligence government services businesses with a foundation built upon our people’s dedication, talent, innovation, commitment to safety and our culture of caring, along with a willingnessAmentum to create a bridgenew, publicly-traded player in the government services sector positioned to address many of the world’s most complex and critical challenges. I’ve seen firsthand the world-class innovation and problem-solving our CMS and C&I teams have brought to Jacobs, and I am excited for the great opportunities ahead.

Our transformational journey would not have been possible without our experienced and highly engaged Board of Directors. We recently welcomed our newest members to the Board, Julie Sloat and Louis Pinkham. With more than 60 years’ experience between them across business, technology manufacturing and energy transition, they bring a stronger, biggertrack

record of scaling ground-breaking products and better Jacobs.services, developing organizations, and building cross-industry, strategic partnerships.

GovernanceIn July 2022, we welcomed Claudia Jaramillo as Executive Vice President, Strategy and Compensation PracticesCorporate Development. Claudia played an important role, alongside then CFO Kevin Berryman, on the issuance of our first-ever Sustainability-Linked Bond in February 2023 and, in August 2023, she transitioned into her new role as Chief Financial Officer. Her record of leadership and operational execution ideally positions her to serve in this role to further advance our strategy.

As your elected fiduciaries, we strongly believe that comprehensive corporate governance oversight, combined with highly talented people executing a compelling strategy, is fundamental to building long-term shareholder value. Furthermore, our Board embraces high levels of integrity and corporate governance processes, with a continuous review and refinementkey member of our practices.executive leadership team since 2014, Kevin has been instrumental in transforming Jacobs into a higher growth, higher value technology-enabled solutions provider. During his tenure, Kevin has been a proactive partner in forming and implementing our strategies and has driven strong financial performance focused on disciplined cost control, robust cash flow generation and effective capital deployment, in addition to demonstrating committed leadership to our cultural transformation.

Board Structure – The BoardI want to thank Kevin for his dedication to the CFO role and the entire Company and I look forward to continuing to work with him as he provides strategic insights to the long-term vision of both independent Jacobs and independent CMS. It’s noteworthy that in Jacobs’ 76 years as a company, we’ve seen only five CEOs and four CFOs, which speaks volumes to our stability in a dynamic world.

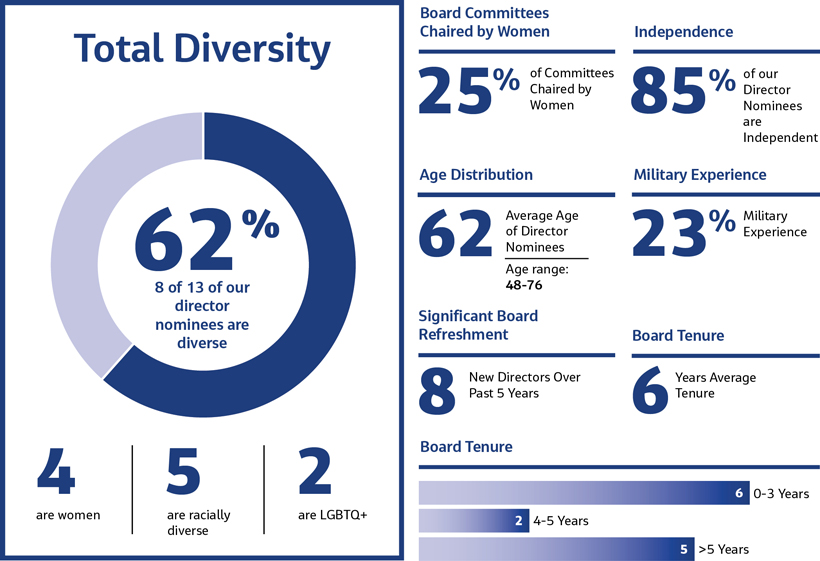

Empowering our people

To provide the best talent to deliver for our clients we must be the best place our people want to work and build a career. At Jacobs, our aim is comprised of 10 members whom together bring rich industry experienceto create an environment that supports our Employee Value Statement — A World Where You Can! This is our commitment to our broadly diverse employees to support them in being their best self and diverse backgrounds. Our Board members are elected on an annual basis under a majority voting standard. The average tenure of our Board members is 8 years, with 4 newly appointed directors within the last 5 years. We plan to add an additional Board member in connection with our planned acquisition of CH2M HILL Companies, Ltd. (“CH2M”).

Oversight – The Board is highly engagedgive them opportunity to continually learn and meets with management on a regular basis to provide strategic guidance, including thorough diligence on acquisition and divestiture opportunities.grow. As part of our Culture of Caring, we promote agile careers to enable our people to develop new skills and unlock career opportunities across our business. Our successful and award-winning programs for our graduates, interns and apprentices, our leadership development programs and other

learning opportunities also empower our people to be their best for our clients. In addition, our global wellbeing programs, tools and benefits integrate physical, mental, financial and social wellbeing, to help our people thrive. We know that the better and more inclusive our team is around the globe, the better we will be in bringing innovative solutions to our clients.

More growth on the horizon

With the major government funding commitments such as the U.S. Infrastructure Investment and Jobs Act, the Inflation Reduction Act and similar mechanisms in the European Union and beyond, the increasing prevalence of climate response and digital enablement is driving a once-in-a-generation opportunity to deliver transformational change to the communities we serve. With our global talent base, we believe we can modernize critical infrastructure across higher margin markets — enjoying additional market-share — with efficient, automated, sustainable and resilient solutions that help

mitigate the climate crisis and deliver connected, secure and smart infrastructure through a lens of social equity and inclusivity.

At Jacobs, we set the standards for what’s possible and we have the capability to bring together the best minds in the industry. We have remained dynamic and agile, delivering for our clients, and evolving into a company of more than 60,000 talented teammates who are united by the purpose of creating a more connected, sustainable world. I would like to thank all our people for their passion and commitment to supporting our clients and delivering the best solutions to drive a positive impact in the world. I’m excited about this next chapter in our transformation and our ability to turn ideas into meaningful, positive outcomes that bring benefits to all our stakeholders.

Bob Pragada

Chief Executive Officer

2024 Proxy Statement |  | iii |

Our client solutions

To help us challenge the accepted and shape the new standards our future needs, our three growth accelerators — Climate Response, Data Solutions and Consulting & Advisory services — create connections between the global market trends, our client solutions and our company purpose.

We engage at every stage of the challenge. Unlocking the possibilities to produce outcomes and solutions for the world’s most challenging issues and critical infrastructure — helping our clients ensure people are connected, have clean energy and water, live in a secure environment, have access to life enhancing therapies and more. Across our sectors, we bring deep capability in high-capacity, fast-ramp projects and more than 50 years of integrated major program delivery experience to support our clients’ most complex needs.

Advanced Manufacturing

| ◾ | We’re delivering four of the largest electric vehicle (EV) manufacturing plants in the U.S.; helping transit agencies, municipalities and state transportation departments win, plan and deploy EV infrastructure funding or other incentives through significant Acts in the U.S. and EU; and we’re also delivering across all aspects of the EV future — from planning fleet transitions to building charging infrastructure and battery manufacturing plants. We’re designing the facilities and managing construction for multiple site locations across North America and Europe to expand manufacturing capacity for sustainable EV batteries. |

| ◾ | We’re capturing unprecedented growth in semiconductors design and construction management in the U.S. and Europe. Ranked No.1 by Engineering News Record for Semiconductors, we’re currently designing semiconductor projects in the U.S., Europe and Middle East. |

| ◾ | We’re partnering with some of the world’s largest technology and data center providers to address critical sustainability and carbon neutrality challenges and driving innovation with renewable power and water technologies. |

Cities & Places

| ◾ | Jacobs is a key player in the design and delivery of major programs that bring the Saudi Vision 2030 of economic transformation through the delivery of social infrastructure. Working with JASARA we are providing project and construction management consultancy services for THE LINE, NEOM Company’s (NEOM) linear and cognitive city under development in the northwest of Saudi Arabia. THE LINE will play a leading role in NEOM’s aim of establishing itself as a new destination for global tourism, industry and innovation. |

| ◾ | We’re facilitating urban transformation, including leading a master planning engagement in New York City to explore the transformation of Rikers Island from a jail complex into a wastewater resource recovery and renewable energy hub. |

| ◾ | We continue supporting the U.S. Department of State Bureau of Overseas Buildings Operations by providing program-level process- and procedure-improvement support, existing facilities surveys and analyses, and other project-specific support. |

Energy & Environment

| ◾ | We’re accelerating contaminated sediment clean-ups for environment and infrastructure projects, addressing and mitigating risks to public health, welfare and environment by supporting the U.S. Environmental Protection Agency’s ambitious goals of cleaning up and restoring 22 out of 25 remaining Great Lakes Areas of Concern by 2030. |

| ◾ | Through an Engineering Partnering Agreement, we’re supporting Fortescue Future Industries on a variety of decarbonization projects across its global ammonia, green hydrogen and renewable energy project portfolio spanning 25 countries. |

| ◾ | Supporting renewable, new energy technology, security and energy resiliency efforts, we completed the underground engineering for the HDD company, the design-build contractor, for Oregon State University’s PacWave South commercial-scale, ocean wave energy testing facility — the first pre-permitted, full-scale test facility for wave energy devices in the U.S. |

| iv |  | 2024 Proxy Statement | 2024 Proxy Statement |

We’re designing a new integrated mental health complex in Western Sydney to provide vital mental health care services to a fast-growing population in Australia.

Building on a more than 15-year relationship with National Grid, under a new General Management Consultancy Framework we’re supporting the energy utility’s business service operations needs in the U.S. and U.K.

We’re leading and managing the 10-year renovation of the S Concourse at Seattle-Tacoma International Airport, U.S., to modernize the 50-year-old concourse. Our strategic advisory services will drive sustainable solutions to support Pacific Northwest’s tourism and business gateway.

Health & Life Sciences

| ◾ | We’re delivering design, construction support and commissioning, qualification and validation for a greenfield monoclonal antibody manufacturing facility. The project uses sustainable design elements and digital design replication to execute a flexible facility that can reduce the time to get products to patients in need. |

| ◾ | We provided construction management services to support the development of WuXi Biologics’ 26-hectare biomanufacturing facility, in Ireland, that incorporates leading-edge technology optimized for the flexible production of diverse drugs. Now in final stage qualification to deliver lifesaving drugs to patients, the facility won the Industrial (over €10m) Category of the 2023 Irish Construction Excellence Awards and was the 2023 operations category winner for the International Society of Pharmaceutical Engineering’s Facility of the Year Awards. |

Transportation

| ◾ | We’re helping to deliver the U.K.’s Transpennine Route Upgrade — this transformative, major program of railway improvements will provide better, faster, more sustainable journeys to passengers traveling across the route spanning 70 miles and 23 stations. |

| ◾ | Using Jacobs’ Streetlight Data Software-as-a-Service offering, we’re helping transportation agencies make better decisions: From aiding cycling and active transport planning, identifying road safety hotspots and solutions, to diagnosing the infrastructure needed to boost equitable access. In the U.S., we’re helping the New Jersey Department of Transportation to study the benefits of marine highways to improve the resiliency of the freight network and support the state’s carbon emission reduction efforts. |

| ◾ | In Denmark, we’re also collaborating with PA Consulting to provide research and strategic management advice to support the operation and maintenance of The Copenhagen Metro as it continues to deliver modern, future-ready services. |

Part of the innovative Strategic Pipeline Alliance, the biggest drinking water grid program in the U.K. in a generation, we’re supporting Anglian Water’s key strategic aims to make the East of England resilient to the risks of drought and flooding and to be a net-zero carbon business by 2030.

Water

| ◾ | We’re providing construction management and design support services for New Zealand’s Central Interceptor, the supersized wastewater tunnel, which will play a crucial role in ensuring cleaner waterways in central Auckland and future-proof the wastewater infrastructure for the city’s growing population. |

| ◾ | We’re actively introducing our advanced digital solutions to our clients across the globe. Notably, our collaboration with the City of Wilmington, U.S., stands out as a prime example of our commitment to driving positive change. In Wilmington, Aqua DNA and Intelligent O&M play a pivotal role in their journey towards risk reduction, enhanced plant operations, waste and energy conservation and a transformative shift towards a net-zero energy footprint. Aqua DNA supports the city with real-time data through smart sensors, while Intelligent O&M delivers direct, predictive guidance to frontline Operations & Maintenance (O&M) staff. |

| ◾ | We’re providing program management, owners engineering services and strategic funding advisory services to Inland Empire Utilities Agency for a major regional water management program that will incorporate indirect potable reuse to create a more sustainable, drought-resilient local water supply in one of the largest groundwater storage basins in southern California, U.S. • |

2024 Proxy Statement |  | v |

At Jacobs we’re invested in creating a more equitable society and a lasting legacy; we do things right, striving to leave our planet and our communities better than we found them.

Aligned with the United Nations (UN) Sustainable Development Goals (SDGs), PlanBeyond® is our approach to integrating sustainability throughout our operations and client solutions — planning beyond today for a more sustainable future for everyone. We’ve invested in a portfolio focused on creating positive social and economic impacts, while protecting our environment and improving resilience.

Our climate response

Climate response is one of three core accelerators in our company strategy and our Climate Action Plan (updated in FY22) sets out our climate mitigation and adaptation commitments.

Our key ambitions focus on oversight,driving positive impact through our operations and client solutions — including achieving net zero across the value chain by 2040 and contributing to the UN SDGs across all of our solutions by 2025.

Our ESG Disclosures Report shares our Environmental, Social and Governance (ESG) performance, reported in alignment with the Sustainability Accounting Standards Board framework and informed by Global Reporting Initiative standards.

Our net-zero targets are approved by the Science Based Targets initiative, and our carbon neutrality status is in line with the international standard PAS 2060. Detailed in our Carbon Neutrality Commitment, we appointedachieved 100% low-carbon electricity, and we became carbon neutral for our operations and business travel in 2020. We continue to maintain these commitments. Our suite of digital tools is enabling us to streamline our ESG data gathering, calculations and analytics.

In FY23, Jacobs launched our inaugural Sustainability Linked Bond (SLB) which further reflects our industry leadership and commitment to incorporating sustainability into the company’s financing strategy. The SLB’s performance is underpinned by two Key Performance Indicators, one that is linked to gender equality and reduced inequalities (UN SDG 5 and UN SDG 10) and the other to climate action (UN SDG 13).

In FY22, we saw a lead independent director61% reduction in total value chain greenhouse gas (GHG) emissions (Scope 1, Scope 2 market-based and Scope 31) to 130,232 tCO2e, from a proforma FY19 baseline that reflects our acquisitions. Our net GHG emissions for Scopes 1 and 2 and Scope 3 business travel after the application of energy attribute certificates (Scope 2 market-based) and carbon offsets for FY22 is zero. Third party verified data for FY23 will be issued in FY242.

We commit that 65% of our suppliers by spend, covering purchased goods and services, will have science-based targets by 2025.

Industry-leading ESG status (FY23) |

Placed on Dow Jones Sustainability World Index 2022. |

Placed on CDP’s “A List” for Climate in 2022. |

Gold medal in the EcoVadis Sustainability Ratings 2022. |

Sustained ISS Prime Status for our ESG corporate rating. |

Received the World Environment Center’s prestigious 2023 Gold Medal Award recognizing our international corporate achievement in sustainable development. |

Awarded five business achievement awards for our environmental industry leadership and social contributions in 2022 from Environmental Business International. |

Jacobs’ Executive Chair of the Board of Directors and former CEO Steve Demetriou received the Individual Leadership Award at the Climate Registry’s Climate Leadership Awards. |

Environment Analyst awarded five-star leader rating for climate & ESG impact. |

Jacobs’ Senior Vice Pre\sident, Office of Global Climate Response & ESG Jan Walstrom was also named Sustainability Leader of the Year in Environment Analyst’s Sustainability Consulting Awards 2023.

| vi |  | 2024 Proxy Statement | 2024 Proxy Statement |

Supporting efforts to catalyze a step-change in climate response ambitions for business, we joined The Climate Pledge, a commitment by companies to reach net-zero carbon emissions by 2040 — a decade ahead of the Paris Agreement’s goal of 2050.

As our business shifts, so do our sustainability ambitions. In FY24, we’ll continue to adapt and pivot our PlanBeyond approach to ensure independent leadershipwe continue to drive positive impact by channeling our expansive capabilities in resilient, inclusive infrastructure, clean water, clean energy, social value and beyond.

Our global communities

Consistent with our values, every year we invest in local communities not only where our employees live and work, but globally, collaborating with charities and not-for-profit organizations to make a positive impact.

Through CollectivelySM, our global giving and volunteering program, employees can support eligible charities with Jacobs matching donations to a certain level, request a company donation to a charity of their choice that is aligned with our values and strategic causes, and receive paid volunteer time and rewards.

In FY23, through Collectively, together we supported communities devastated by the boardroom.

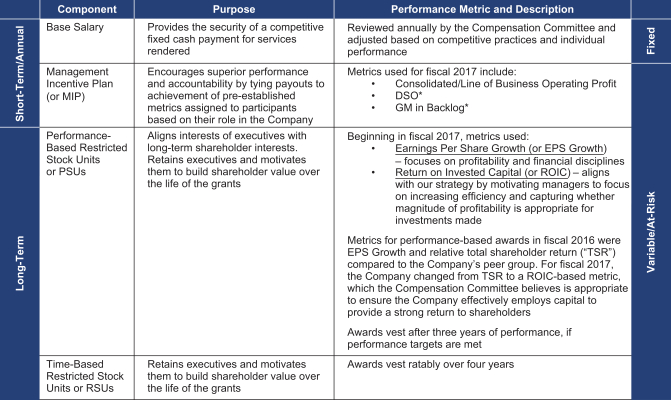

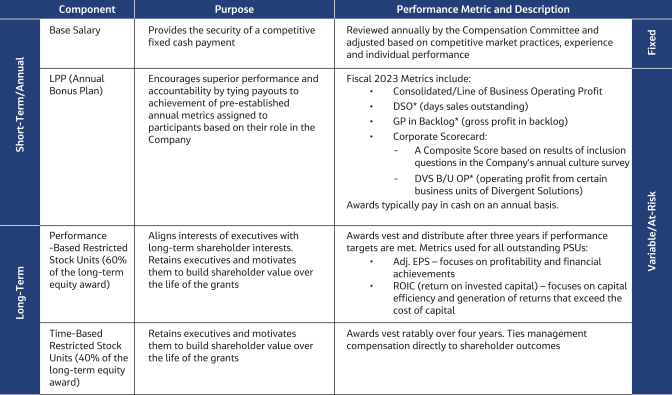

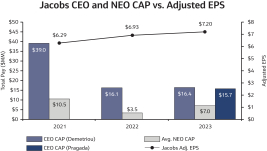

Executive Compensation – We believecontinuing war in pay for performance executive compensation that incentivizes creatingUkraine and sustaining long-term shareholder value. The majority ofevents including the compensation for our named executive officers is performance-based. This compensation is dependent on the achievement of a combination of both near-termearthquake in Türkiye and long-term financial targets.Syria. We also hold shareholder advisory votes on “say-on-pay” on an annual basis.

Value Creation Strategysupported organizations including Team Rubicon, a veteran-led humanitarian organization serving global communities before, during, and after disasters and crises.

We began fiscal 2017joined companies around the world in signing the Ukraine Business Compact 2023 — a declarative statement of international business support for Ukraine’s recovery.

Twelve Jacobs employees participated in our 15th Bridges to Prosperity bridge build, constructing a footbridge in Rwanda, that now provides over 2,700 local community members with an “investor day” outliningyear-round safe passage.

Our annual Water for People campaign raised more than $230,000 in corporate and employee funds to create local water and sanitation utilities around the globe.

Around the world, our three-year strategypeople deliver a science, technology, engineering, arts and showcasingmathematics (STEAM) education and engagement program that supports our business and cultural transformation initiatives. Our strategy is based on three key priorities:

Build a High Performance Culture – Reinforce a culture of accountability, inspirational leadership and innovation that will drive long-term outperformance.

Transform the Core – Fundamentally change the way we operate to improve project delivery, sales effectiveness and business excellence.

Grow Profitably – Execute a balanced strategy focused on organic growth, acquisitions and active management of portfolio of businesses to drive profitable growth in the most attractive sectors and geographies.

Throughout the organization, our culture is the foundation on which we build our reputation of excellence in the markets we serve. This strong foundation is based on our longstanding commitment to safetyequality, inclusion and integrity, supported by four core values: (1)diversity. The Butterfly Effect is designed to enable young people areto develop the knowledge and understanding they need to put sustainability at the heart of everything they do.

Delivering our business, (2) clients areAction Plan for Advancing Justice and Equality

Our Action Plan for Advancing Justice and Equality focuses on advancing Black and historically underrepresented employees and contributing to structural change in broader society. We continue to work toward our valued partners, (3) performance excellence isfive-year target of investing $10 million by mid-2025 to support targeted charitable donations, further STEAM outreach efforts to historically underrepresented groups, increase our support of diverse suppliers, and strengthen our commitment to developing and (4) profitable growth is an imperative.hiring the best diverse talent. In FY23, we invested approximately $1.7 million toward this commitment.

As partWe are supporting several Historically Black Colleges or Universities (HBCUs), including Howard University where the Jacobs Equity and Advancement Program, a scholarship program and student engagement plan, provides monetary supplement to STEAM education, as well as supporting opportunities for research, mentorship and continued STEAM outreach.

We have completed our $1M support to build and open SEED School of LA County, proudly serving 400 at risk students from one of the city’s most historically disadvantaged neighborhoods.

We’re supporting the Cowrie Scholarship Foundation’s mission to graduate 100 disadvantaged Black Britons through

U.K. universities in the next decade. And, we’re working with 20/20 to help racially underrepresented people to access career and business development opportunities. We’re partnering with Tent’s LGBTQ+ Refugee Mentorship Initiative, pairing Jacobs mentors with LGBTQ+ refugees fleeing persecution. While industry benchmarks for supplier

| ~21K | ||

EMPLOYEE VOLUNTEER HOURS TRACKED | ||

| ~34.35% | ||

DIVERSE SUPPLIER SPEND | ||

| $3.2M+ | ||

JACOBS’ CHARITABLE DONATIONS IN FY23 | ||

| $2.18B | ||

SPEND ON DIVERSE, MINORITY-OWNED & DISADVANTAGED BUSINESSES | ||

| 2.7K+ | ||

CHARITIES SUPPORTED | ||

| $10M | ||

SUPPORT OVER FIVE YEARS TO HISTORICALLY UNDERREPRESENTED GROUPS | ||

diversity currently average around 7.2% of total spend, in FY23 we spent $2.18 billion on diverse, minority-owned and disadvantaged businesses, representing approximately 34.35% of our effort to transform the core of our business, we completed a restructuring program that we expect will result in annual cost savings of over $289 million. During fiscal 2017, we also invested approximately $30 million in technology modernization and process improvements to enhance our business capabilities and improve client service.total supply chain spend.

2018 Proxy Statement|

To reinforce2 We are externally verifying our management’s focus on profitable growth, we introduced a gross margin in backlog metric to our short-term incentive planFY23 emissions and added return on invested capital (ROIC) as a performance metricwill be including that data in our long-term incentive plan. These new metrics align our leaders’ performance more closely with building long-term shareholder value.

As we progressed through fiscal 2017, we demonstrated consistent execution against our financial strategy to achieve profitable growth. In the fourth quarter, revenue inflected to growth and gross margin percentage was 18%, up from 16% in the year ago period.

From an organic growth standpoint, we had a number of significant new project wins in keyend-markets. For example, in our Aerospace & Technology business, we were awarded a $4.6 billionfollow-on contract for Integrated Research and Development Enterprise Solutions. In our Buildings & Infrastructure business, we signed a historic joint venture agreement with Saudi Aramco to develop new social infrastructure throughout Saudi Arabia and the Middle East region.

In the fourth quarter, we announced our agreement to acquire CH2M. This acquisitionFY23 ESG Disclosures Report which is expected to be transformationalavailable soon.

2024 Proxy Statement |  | vii |

Our people and culture

Our people and our culture are fundamental to what truly makes Jacobs. Authentic leadership and a commitment to living our core values every day creates trust, respect and empowerment across our business. It helps us stay focused on our Culture of CaringSM to deliver the best outcomes for all our stakeholders.

By fostering learning and unlocking career opportunities for our people, we attract and retain the best talent to deliver for our clients and fuel long-term growth for Jacobs. Our expanded global resources help our talent around the globe grow and develop careers while also sharing expertise and specialized skills.

A world where you can

Our people can pursue different careers and lifelong professional opportunities at Jacobs. We promote and foster agile careers enabling employees to develop new skills and accelerate learning in different areas of our business. Our Jacobs Go! Program provides six-month roles that encourage career growth and greater understanding across our global footprint.

Developing the next generation of professionals, our global graduate development program and our local apprenticeships transition our future talent into our community with the skills, networks and knowledge

necessary to create the foundation for a successful career at Jacobs. We also provide our interns with practical, relevant “real life experience” to help support their professional goals.

We introduced our Returnship Program for talented professionals looking to refresh skills and reignite careers after an extended career break. As an employer of choice for diverse talent, this program enables us to bring more innovative thought and solutions into our teams to support our clients.

One of our most successful leadership programs has been our award-winning CEO Leadership Roundtable series which helps our people leaders and influencers around the world to strengthen their leadership capabilities and grow as inspiring, impactful leaders.

We’re continually working to broaden the combined company willpipeline of diverse talent, providing an environment where people of all backgrounds, ethnicity, gender, geography, disability, sexuality or any other characteristic, can thrive. Given the typically lower female representation in STEAM careers, we’re particularly focused on empowering our female talent to help advance our innovation and growth.

Partnerships and recognition |

Earned the top score in the 2023 Disability Equality Index, a U.S.-based benchmarking tool for corporate policies and practices related to disability and workplace equality. |

For the third consecutive year, named one of The Times Top 50 Employers for Gender |

Equality 2023, the U.K.’s most highly profiled and well-established listing of employers striving for gender equality in the workplace. |

Ranked on the Social Mobility Foundation Employer Index 2023 of the top 75 employers. |

Honored as a 2023 VETS Indexes 4 Star Employer, recognizing our commitment to recruiting, hiring, retaining, developing and supporting veterans and the military-connected community. |

Proud to again be ranked No. 6 in Stonewall’s U.K. Workplace Equality Index (WEI) Top 100 Employers List for LGBTQIA+ People and retain Stonewall’s Gold Award. |

Received the People First and Large Firm of the Year awards from Consult Australia. |

Committed to Hiring Our Heroes, designed to help veterans, transitioning service members and military spouses find meaningful employment opportunities. |

Partnering with the U.S. Department of Defense on their SkillBridge program. |

Partnering with the Viscardi Center and the National Business Disability Council’s |

Emerging Leaders program, an initiative aimed at empowering college students living with disabilities and developing them for business leadership positions. |

| viii |  | 2024 Proxy Statement | 2024 Proxy Statement |

We’re working to significantly improve our global gender balance by fiscal year 2025, with our aspiration to achieve 40% female talent, 40% male talent and 20% being a flexible measure — including any gender and those who choose not to identify or disclose. We extended this aspirational goal in our new, industry-leading Sustainability-Linked Bond Framework, where the interest rates payable on the bonds are tied to Jacobs’ efforts to increase gender diversity in leadership positions by 2028.

Focus on wellbeing

Our TogetherBeyondSM approach supports a workplace where we are curious, embrace different perspectives and harness new ideas to bring the innovative, extraordinary solutions clients demand from us. We know that if our people feel connected and that they belong, then there is no limit to who they can be and what we can achieve together.

Whether they connect through our Jacobs Employee Networks, our Communities of Practice, or other ways, our people collaborate and drive pivotal initiatives within Jacobs that directly impact our clients and create a workplace where everyone thrives.

Integrating physical, mental, financial and social wellbeing, our global wellbeing programs, tools and benefits put our people and their families first, giving them resources and support to be at their best. Our new global financial counseling helps our people globally manage their finances now and into the future. We’ve partnered with Carrot to bring free, inclusive fertility healthcare and family-forming benefits for all paths to parenthood and provide support for menopause, low testosterone and more. We also expanded our parental leave in priority growth sectors such as Transportation, Social Infrastructure, Water, Nuclear, and Environmental Services. In additionthe U.S.

We’re working to the CH2M acquisition, in fiscal 2017, we made a number of smaller strategic acquisitions. We acquired Aquenta Consulting Pty Ltd, which strengthened our integrated project services delivery capabilities in Asia-Pacific, and Blue Canopy to further strengthen our capabilities in data analytics, cybersecurity services and application development.

While acquisitions are a componentdrive inclusion of our strategy, as part of our active portfolio management we also evaluate asset divestures. During the fourth quarter we sold our 40% ownership in Neste Jacobs Oy, a joint venture with Neste Oy which was supporting certain energy operationsLGBTQ+ family, and clients.

During fiscal 2017, as part of our ongoing commitment to drive long-term shareholder value, we initiated a quarterly dividend of $0.15 per share and repurchased an aggregate of $97.2 million in shares.

In summary, 2017 was a transformative year for Jacobs. We are pleasedprovide them with the Company’s performance during the yearappropriate support by reviewing all key Jacobs family policies for inclusiveness, regardless of gender or gender identity.

We commenced our BeyondZero® journey in 2007, and we remain confidentcommitted to prioritizing work that is healthy, safe and secure for our people and our planet, and we’re proud to have demonstrated safety excellence

with another year of zero employee fatalities at work and a total recordable incident rate1 of 0.20, compared to the North American Industry Classification System’s most recently reported2 aggregate rate of 0.60.

Jacobs’ One Million Lives (OML) app continues to grow in momentum, providing a free, publicly available, mental health check-in tool with a resources website that enables users to check their own mental health and access proactive strategies for personal mental health development. Over 40,000 One Million Lives check-ins were completed between December 2020 launch and our abilityfiscal year end 2023.

1 As at October 15, 2023 and recorded in accordance with OSHA record keeping requirements, but subject to execute againstchange thereafter due to possible injury/illness classification changes. The TRIR calculation uses the U.S. OSHA formula of ‘Number of Incidents x 200,000 / total number of hours worked in a year’. The 200,000 is the benchmark established by OSHA because it represents the total number of hours 100 employees would log in 50 weeks based on a 40-hour work week.

2 Cited on September 14, 2023 via U.S. Bureau of Labor Statistics — Incidence rates of non-fatal occupational injuries and illnesses by industry and case types, 2021 for NAICS code 54133.

| 0.20 | ||

TOTAL RECORDABLE INCIDENT RATE | ||

| 40K+ | ||

ONE MILLION LIVES CHECK-INS SINCE LAUNCH TO FISCAL YEAR END 2023 | ||

| 2,000+ | ||

ACTIVE POSITIVE MENTAL HEALTH CHAMPIONS | ||

Through our three-year strategic planeight Jacobs Employee Networks and other internal communities, our people play a critical role in attracting new talent into our business, and helping to enhance shareholder value, while maintainingshape our high standards of corporate governance.policies and our accessibility practices.

We look forward to your attendance at our annual shareholder meeting on January 17th in New York City.

2024 Proxy Statement |  | ix |

(This page intentionally left blank.)

|  | 2024 Proxy Statement | 2024 Proxy Statement |

ii

|2018 Proxy Statement